An employer may be obliged to pay the employer’s liability component if it has dismissed or laid off a person close to retirement age and the employee has been unemployed or laid off for a long period. Liability component payments are used to finance unemployment benefit expenses incurred by terminations and layoffs.

The employer's liability component applies to employers whose payroll, which serves as the basis for the calculation of the unemployment insurance contribution, exceeds the annually specified minimum level. The payment is based on the Act on the Financing of Unemployment Benefits.

The employee's continued unemployment allowance is discontinued. As the right to the continued unemployment allowance is discontinued, the employer's obligation to pay the liability component for employees who have been given notice or laid off will end. The right to continued unemployment allowance and the liability component will end after the transition period. Employees born in 1964 are the last age group entitled to the unemployment allowance and for which the employer is obliged to pay the liability component. Employees born in or after 1965 are not entitled to the unemployment allowance, and the employer is not obliged to pay the liability component for them.

The right to continued unemployment allowance is replaced by the right to receive the restructuring protection package and the employer's obligation to pay the restructuring protection fee from the beginning of 2023. Read more about the restructuring protection fee here.

If, during the transition period, the employer is obliged to pay both the restructuring protection fee and the liability component for the same employee, the restructuring protection fee will be deducted from the liability component.

The amount of the liability component and the restructuring protection fee is determined on the basis of the employer's payroll subject to unemployment insurance contributions. The payroll's minimum and maximum levels are the same for the liability component and the restructuring protection fee. That is to say, the smallest employers will not be obliged to pay the restructuring protection fee.

The employer will not be obliged to pay the liability component if any of the following conditions are met:

The employer's liability component applies to employers whose payroll, which serves as the basis for the calculation of the unemployment insurance contribution, exceeds the annually specified minimum level. At the minimum level, the liability component is zero. From the minimum level, the liability component increases linearly to the maximum limit for full liability.

The liability component is calculated on the basis of the payroll amount for the year preceding the dismissal, or the payroll amount for the year before notice of a temporary layoff was given.

A State employer’s liability component is based on the payroll amount serving as the basis for the employee contributions of an accounting unit or state-owned company.

If the company has undergone a merger prior to the day of dismissal, during the year of dismissal, or in the year preceding the dismissal, the employer’s liability component is determined on the basis of the merged companies’ total payrolls that served as the criterion for the unemployment insurance contribution of the year preceding the dismissal.

This also applies in situations where other businesses have been merged with the company during the year when notice of a temporary layoff was given and prior to the date of such notice, or in the year preceding the year in which the notice of temporary layoff was given.

| Payroll year | Minimum level (euro) | Maximum limit for full liability (euro) |

| 2013 | 1 990 500 | 31 848 000 |

| 2014 | 1 990 500 | 31 848 000 |

| 2015 | 2 025 000 | 32 400 000 |

| 2016 | 2 044 500 | 32 712 000 |

| 2017 | 2 059 500 | 32 952 000 |

| 2018 | 2 083 500 | 33 336 000 |

| 2019 | 2 086 500 | 33 384 000 |

| 2020 | 2 125 500 | 34 008 000 |

| 2021 | 2 169 000 | 34 704 000 |

| 2022 | 2 197 500 | 35 160 000 |

| 2023 | 2 251 500 | 36 024 000 |

| 2024 | 2 337 000 | 37 392 000 |

| 2025 | 2 455 500 | 39 288 000 |

Employer’s liability component is imposed either of employee’s continued unemployment allowance or of the actual unemployment allowance.

The liability component is a one-off charge for the employer per each employee made redundant or laid off.

We charge the employer a liability component if an employee is entitled to continued unemployment allowance, as specified in the Act on Unemployment Security, as a result of dismissal or layoff and the other requirements for payment liability are met.

We charge a liability component at the start of the entitlement to continued unemployment allowance, which is usually approximately two years from the end of the employment relationship if the person has received an unemployment allowance for the maximum period (400/500 days). The 500-day maximum is reached in just under two years if the person receives an unemployment allowance continuously for the entire period.

The requirements for receiving continued unemployment allowance are:

Unemployment funds and the Social Insurance Institution of Finland (Kela) investigate and grant the entitlement to continued unemployment allowance.

The employer may also be obliged to pay the liability component if an employee has become entitled to the unemployment allowance due to the termination of their employment

The liability component from unemployment allowance costs applies to those persons who have not yet transferred to the continued unemployment allowance depending on the year of birth before the age of either 63, 64 or 65.

In the foregoing cases, we will charge the liability component when the dismissed employee reaches the age of 63, 64 or 65. In such cases, the benefit costs equivalent to the unemployment allowance actually paid to the person after the termination of employment serve as the basis for the liability component, and there is no minimum level for the benefit costs.

In addition to the dismissal or temporary layoff of an employee, the employer may be obliged to pay the liability component in situations in which it has contributed to the termination of a person's employment in one way or another.

If an employer pays an employee a financial benefit related to the termination of employment, this can indicate that they employer has contributed to the cessation of employment, even if the employee himself/herself resigns the position. The employer may also contribute to situations in which the employment relationship is terminated by mutual agreement.

If the reason for the cessation of employment is unclear, we may ask the employer and also the employee to clarify the reason for the cessation of employment.

In addition to the employer’s payroll, the liability component is affected by the unemployment allowance paid to the dismissed employee and the period of time for which the unemployment allowances are covered by the employer.

The 500-day maximum for unemployment allowance is reached in approximately two years if the dismissed employee receives an unemployment allowance continuously for the entire period. If there are breaks in the payment of the unemployment allowance, during which no unemployment allowance is paid to the dismissed employee, the maximum period is postponed. This, in turn, postpones the commencement of the person’s continued unemployment allowance.

Examples of situations in which no unemployment allowance is paid to a dismissed employee:

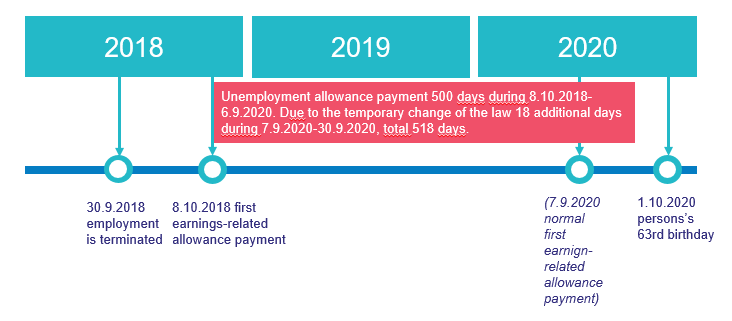

Due to the coronavirus pandemic, the maximum payment period for unemployment allowance has not elapsed

Due to the temporary change of the law because of the coronavirus pandemic, the maximum unemployment allowance payment period (usually 500 days) has not elapsed for unemployed or laid-off persons between 1 July and 31 December 2020. The maximum payment period has also not elapsed between 16 March and 30 June 2020, if the person has been laid off and the lay-off began on or after 16 March 2020. Since the maximum payment period has not elapsed, the number of person’s benefit days may exceed 500 days.

The change of the law may cause that the basis of the liability component changes, as a person may reach the age of 63 before he becomes eligible for continued unemployment allowance. The final amount of the liability component may differ from the amount given by liability component calculator, for example.

Example

The person was born on 1 October 1957 and the employment terminated on 30 September 2018. The person's first earnings-related allowance payment date was on 8 October 2018, and the last payment date before his 63rd birthday was on 30 September 2020.

The person's entitlement to continued unemployment allowance would normally have started after the maximum payment period of 500 days had passed (about two years) starting from 7 September 2020. The continued unemployment allowance would have been paid until the last preceding weekday before the person's 63rd birthday on 30 September 2020, between 7 and 30 September 2020 (18 additional days).

As the maximum payment period for the person's earnings-related allowance has not elapsed since 1 July 2020, he is not entitled to the continued unemployment allowance. For this reason, the basis for the liability component is the benefit expense corresponding to the actual earnings-related allowance (518-day allowance period) paid to the person after the termination of the employment. This is because he has reached the age of 63 before the entitlement to the continued unemployment allowance would have begun.

Due to the coronavirus pandemic, it was possible to receive unemployment benefit during the waiting period

Due to the temporary change of the law caused by the coronavirus pandemic, the unemployment funds and the Social Insurance Institution of Finland (KELA) have paid benefits regardless of the waiting period of the unemployment allowance. This applies to the waiting period for the unemployment allowance, which has started 16 March and continued to 31 December 2020.

Under normal circumstances, the waiting period for unemployment allowance is five working days, during the time there is no entitlement to unemployment allowance. Therefore, the final liability component amount may be higher than the liability component calculator indicates.

If an employee is paid a financial benefit in relation to the termination of employment and the benefit must be divided into periods in accordance with the Act on Unemployment Security, this will prevent the payment of unemployment allowance for the duration of the period of division. According to the act that entered into force at the beginning of 2024, the payment of holiday compensation also prevents the receiving of unemployment allowance for the period during which it is divided into a period as referred to in the Act on Unemployment Security. A holiday compensation equal to one month’s pay will postpone the start of the unemployment allowance period by about one month. Therefore, the payment of a financial benefit and holiday compensation affects the date on which the dismissed employee begins receiving a continued unemployment allowance. Consequently, they also affects the employer’s liability component, if the liability component is collected from continued unemployment allowance costs.

It is possible that, without the financial benefit or periodisation of the holiday compensation, the dismissed employee would not become entitled to continued unemployment allowance before reaching the age specified in the Act on Unemployment Security, but, as a result of the payment of the financial benefit and holiday compenstaion and its division into periods, the age specified in the Act is reached, and the person becomes entitled to continued unemployment allowance.

According to the Act on Unemployment Security, a benefit and holiday compensation that is divided into periods postpones the start of a person’s entitlement to unemployment allowance and, consequently, also affects the amount of the liability component in situations in which the liability component is collected from unemployment allowance costs.

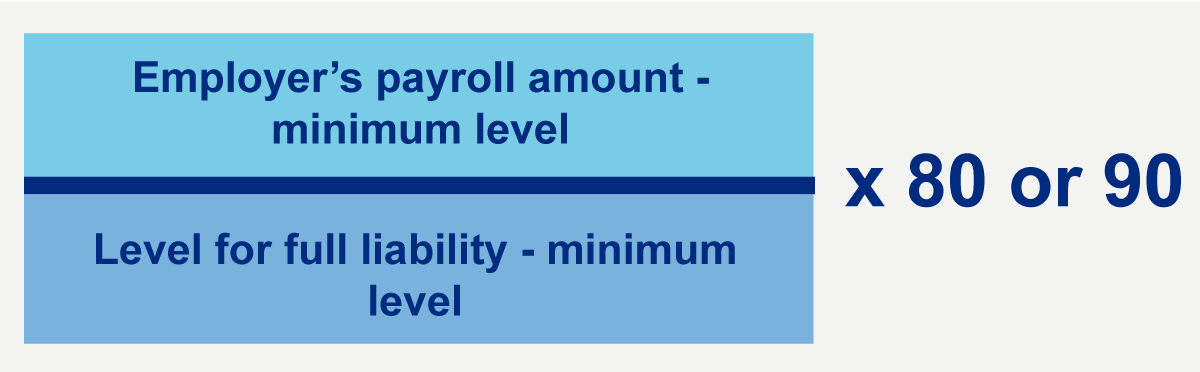

The amount of the liability component is determined on the basis of the employer’s percentage of the liability component. The percentage of the liability component is determined on the basis of the payroll sum on which the unemployment insurance contributions are based.

The percentage of the liability component increases linearly on the basis of the employer’s payroll. The liability component percentage is 0–80% for persons born in 1955 and 1956. The liability component percentage for those born in 1957 or later is 90%.

1) If the employer’s payroll is less than the minimum level for the payroll, the liability component percentage is 0.

2) If the employer’s payroll is greater than the level for full liability, the percentage of the liability component is 80 or 90.

3) If the employer’s payroll is greater than the minimum level for the payroll but less than the level for full liability, the percentage of the liability component is calculated using the following formula:

In the formula above, the minimum level of the payroll amount for the year in question is deducted from the employer's payroll amount. The result is divided by the maximum limit for the full liability component from which the minimum level of the payroll amount for the year in question has been deducted. The result is multiplied by 80 or 90 (the maximum limit for the full percentage of the liability component).

You can also calculate an estimate of the liability component amount and the percentage of the liability component using the liability component calculator.

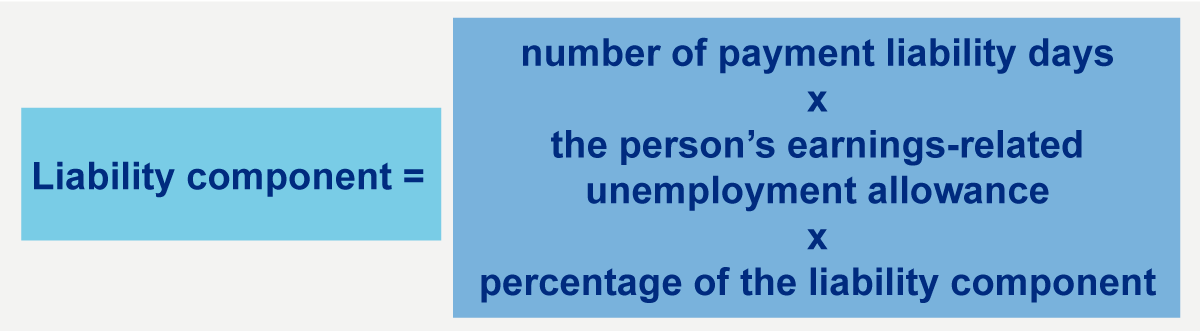

In addition to the percentage of the liability component, the payable amount is affected by the period of time for which the unemployment allowance paid to the dismissed employee is covered by the employer, as well as the amount of unemployment allowance paid to the employee.

The liability component is calculated by using the following formula:

If the liability component is collected from continued unemployment allowance costs, the number of payment liability days is the number of weekdays (Mon–Fri)

If the liability component is collected from unemployment allowance costs, the liability component is determined on the basis of the benefit actually paid to the person from the end of the employment to the person’s 63rd birthday, or up to the date on which the person retires after having reached the age of 62.

| Year of birth | 1960 | 1961 | 1962 | 1963 | 1964 | 1965 |

| Liability component from a continued unemployment allowance (at the earliest) | 61 yrs | 62 yrs | 62 yrs | 63 yrs | 64 yrs | No liability component |

| Liability continues untill the employee turns* | 63 yrs | 64 yrs | 64 yrs | 65 yrs | 65 yrs | No liability component |

| Pending at the earliest (year) | 2021 | 2023 | 2024 | 2026 | 2028 | - |

*The minimum liability component from a continued unemployment allowance is a year’s unemployment allowance.

If the liability component is collected from unemployment allowance costs, the liability component is determined on the basis of the benefit actually paid to the person

| Year of Birth | 1960 | 1961 | 1962 | 1963 | 1964 | 1965 |

| Liability component from an unemployment allowance (at the earliest) | 60 yrs | 61 yrs | 61 yrs | 62 yrs | 62 yrs | No liability component |

| Liability continues untill the employee turns | 63 yrs | 64 yrs | 64 yrs | 65 yrs | 65 yrs | No liability component |

| Pending at the earliest (year) | 2023 | 2025 | 2026 | 2028 | 2029 | - |

You can calculate an estimate of a person’s earnings-related unemployment allowance using the calculator on the website of the Federation of Unemployment Funds in Finland (TYJ).

When calculating the liability component, a benefit equal to the earnings-related unemplo yment allowance is always used, regardless of whether the person has received an allowance that is earnings-related.

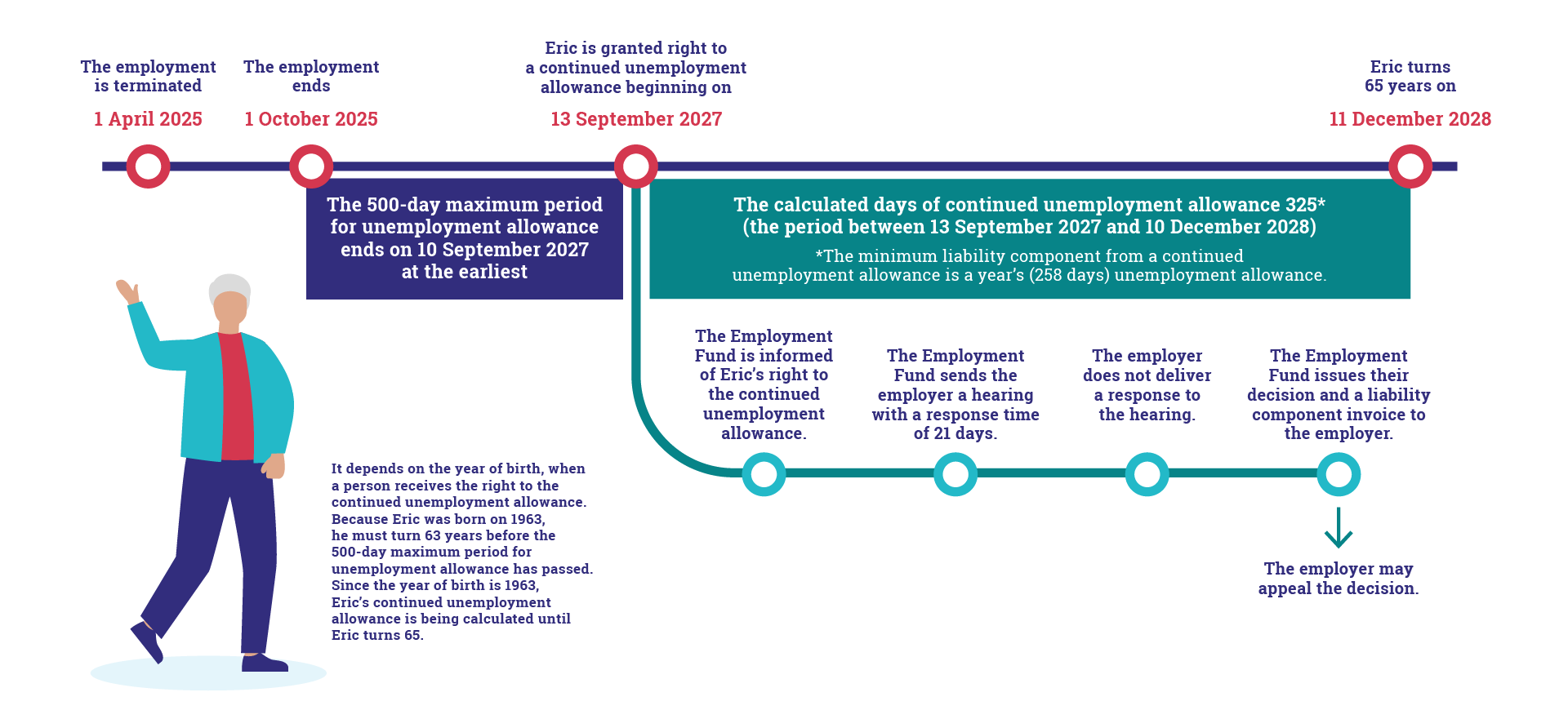

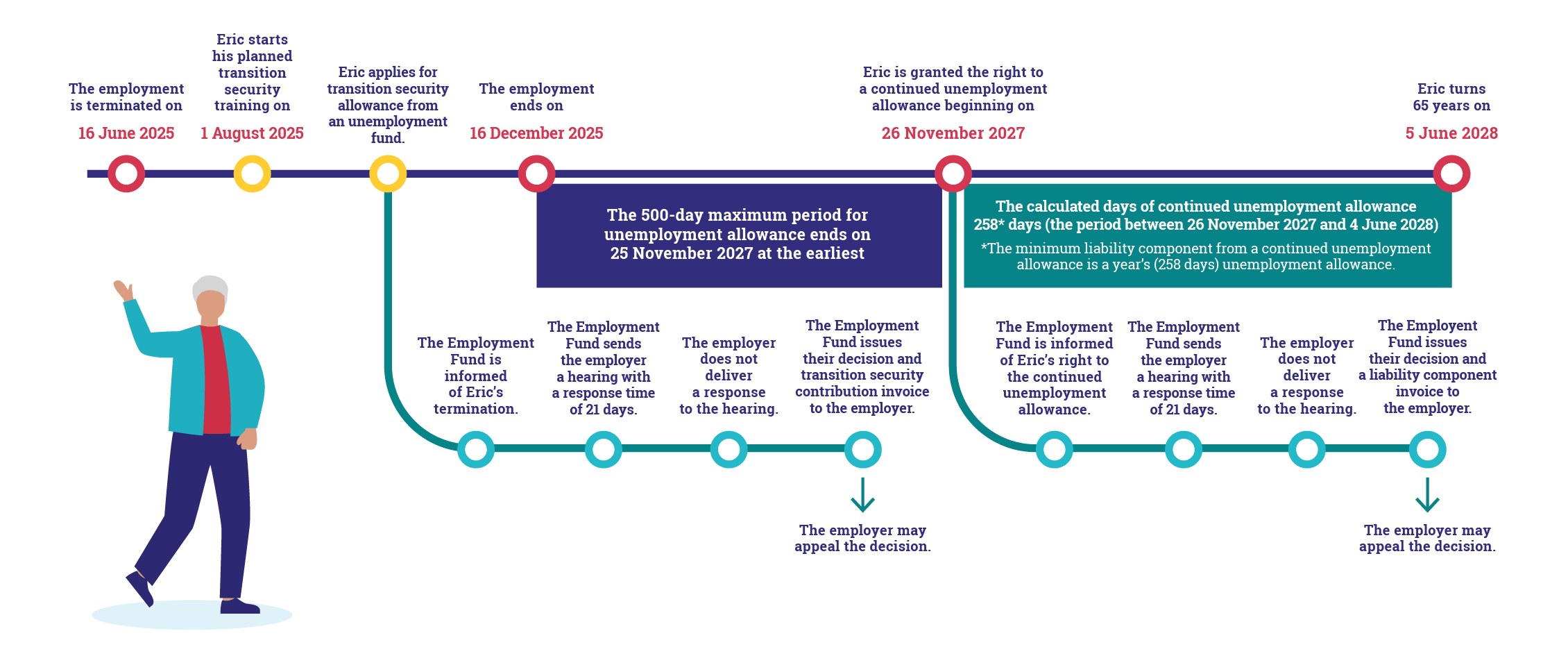

Company Ltd. gives Eric Example notice of dismissal on 1 April 2025 with effect as of 1 October 2025. Eric was born on 11 December 1963 and his employment at Company Ltd. began on 15 January 2010. Eric's earnings-related unemployment allowance is EUR 88.50 per day corresponding approximately average monthly earnings of EUR 3,400. Company Ltd.’s total payroll in 2024 is EUR 10,000,000.

Company Ltd.’s costs for discharging EricThe employer’s percentage of the liability component: (10,000,000 – 2,337,000) ÷ (37,392,000 – 2,337,000) x 90 % = 19.67 % The employer’s liability component: 325 days x EUR 88,50 per day x 19.67 % = EUR 5,657.58 |

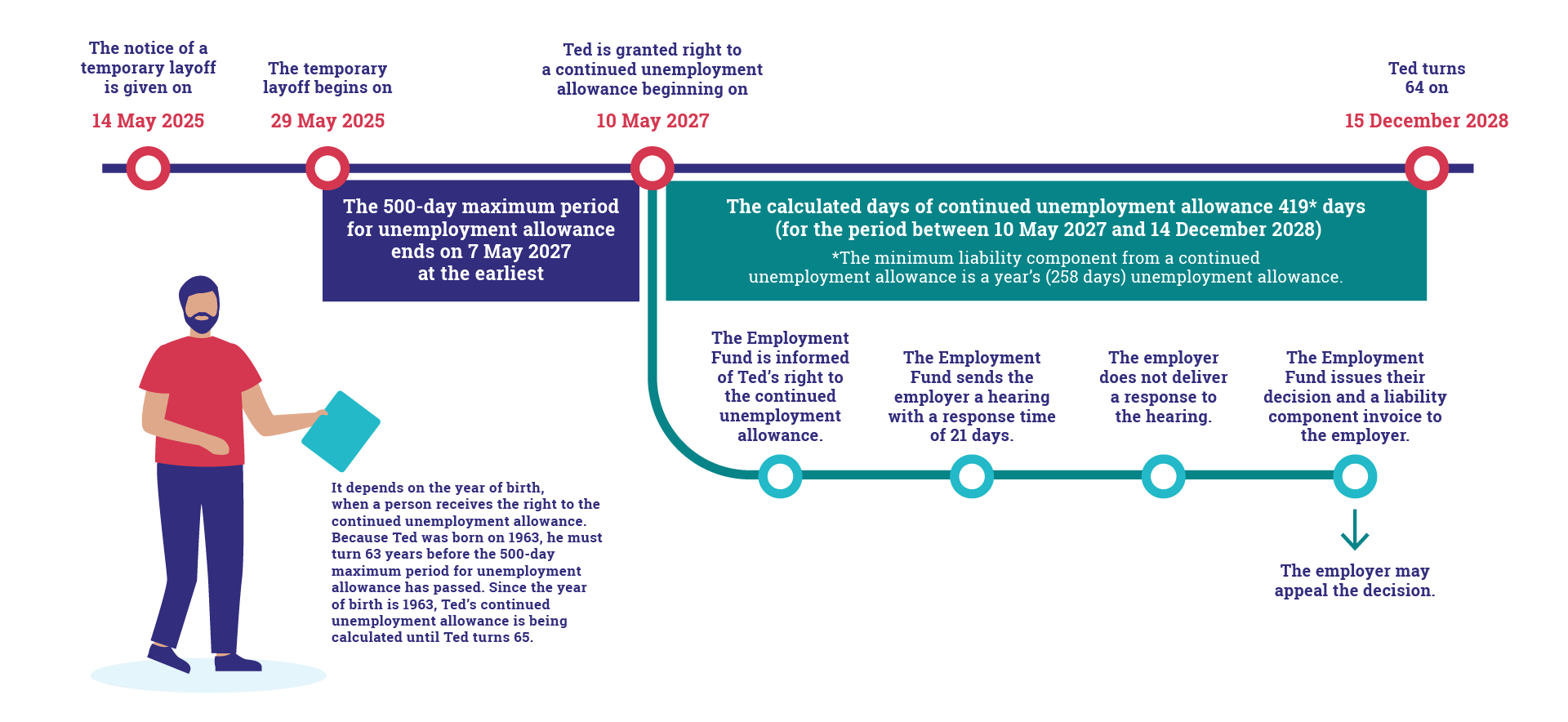

Firm Ltd. gives Ted Employee notice of a temporary layoff on 14 May 2024 and the first day of layoff is 29 May 2024. Ted was born on 15 December 1963 and his employment at Firm Ltd. began on 15 January 2010. Ted's earnings-related unemployment allowance is EUR 88.50 per day corresponding approximately average monthly earnings of EUR 3,400. Firm Ltd.’s total payroll in 2023 is EUR 25,000,000.

Firm Ltd.’s costs for Ted’s temporary layoffThe employer’s percentage of the liability component: (25,000,000 – 2,337,000) ÷ (37,392,000 – 2,337,000) x 90 % = 58,18 % The employer’s liability component: 419 days x EUR 88,50 per day x 58,18 % = EUR 21,574.02 |

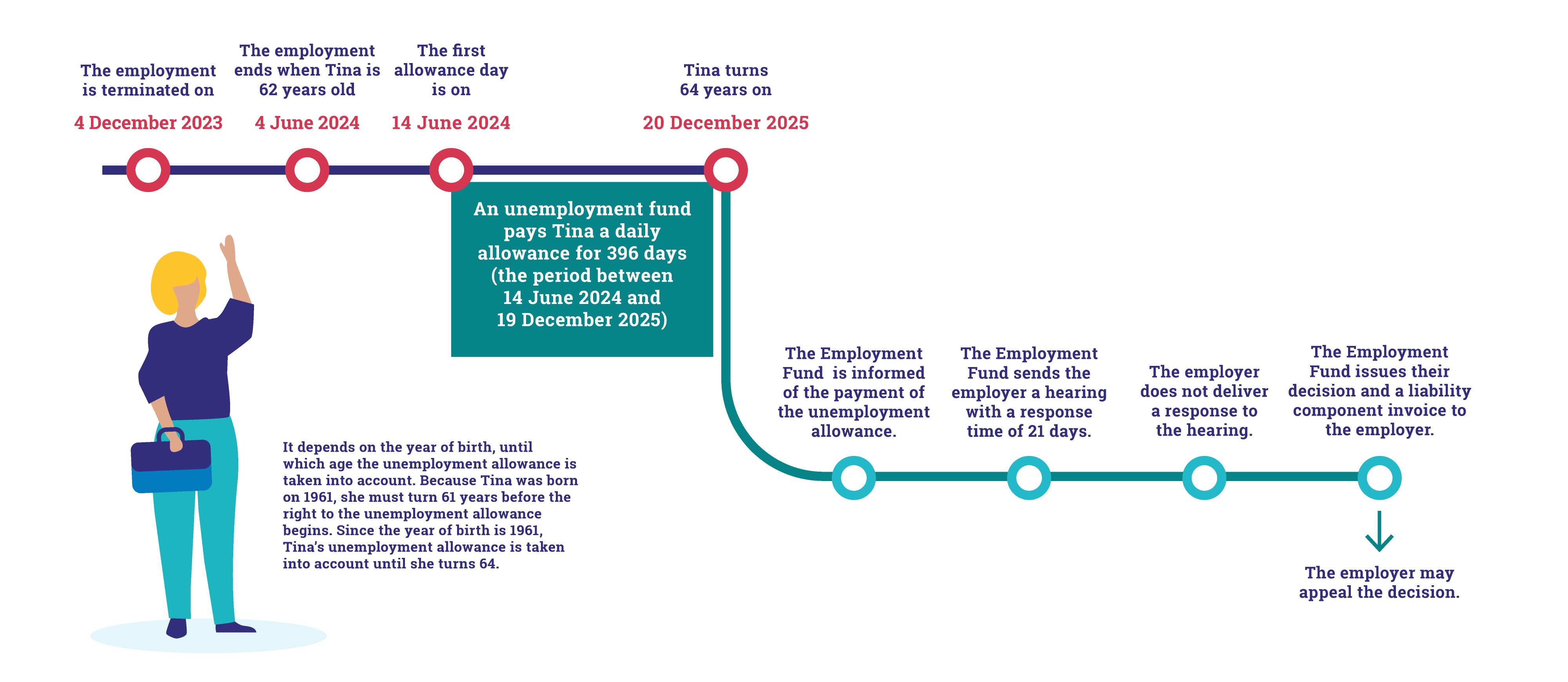

Big Business Plc gives Tina Employee's notice of dismissal on 4 December 2023 and the employment relationship ends on 4 June 2024. Tina was born on 20 December 1961. Her earnings-related unemployment allowance is EUR 88.50 per day corresponding approximately average monthly earnings of EUR 3,400. The employment began on 1 October 2005. Big Business Plc’s total payroll in 2022 is EUR 125,000,000.

Big Business Plc’s costs for discharging TinaThe employer’s percentage of the liability component: 90 % (the employer’s payroll is greater than the level for full liability) The employer’s liability component: 396 days x EUR 88.50 per day x 90 % = EUR 31,541.40* *The basis for the liability component is the benefit expense corresponding to the unemployment allowance actually paid for Tina after her employment ended, since Tina turns 64 before she is transferred to the continued unemployment allowance. |

Company Ltd.’s costs for discharging EricTransition security contribution multiplier: Transition security contribution: EUR 3,400 x 2.05 = EUR 6,970.00 The employer’s percentage of the liability component: The employer’s liability component: The transition security contribution will be deducted from the liability component EUR 19,147.75 – EUR 6,970.00 = EUR 12,177.75 (is taken into account in the hearing, decision and invoice of the liability component). |

We advise employers on matters concerning the liability component. With regard to matters related to unemployment benefits and security, advice is provided by the unemployment funds and Kela. Advice on matters related to earnings-based pensions is provided by the employer's own employment insurance institution.

See contact information here.

You can use the estimation calculator to calculate an estimate of the amount and percentage of the liability component.

The estimation calculation is only an indication and is not to be regarded as an advance ruling.

1. Processing

We are notified by the unemployment fund or Kela when a person’s employment has ended. During processing, if we notice that the requirements have been met to obligate the employer to pay the liability component, we send a hearing letter to the employer. In the processing stage, we may ask for further clarification from the employer, employee, unemployment fund, or Kela, among others.

2. Hearing and decision

The employer has 21 days to deliver a response to the hearing letter.

A) The employer does not deliver a response

We issue a written decision on the liability component, obligating the employer to pay the liability component, and we send the employer an invoice for the liability component.

B) The employer delivers a response

We examine whether there are grounds for exemption from the liability component. To resolve the matter, we may request additional information from parties such as the employee, unemployment fund or Kela.

3. Appeals

If the employer is not satisfied with the decision, he/she may appeal to the Social Security Appeals Board. The employer can appeal a decision made by the Social Security Appeals Board at the Insurance Court.

For more detailed instructions see: appeals and refunds of the liability component

The invoice for the payment of the liability component will be sent to the billing address you have provided for liability component and transition security contribution invoices.

If you have not provided a separate billing address, the invoice for the payment of the liability component will be sent primarily as an e-invoice. The e-invoice will be delivered to the address listed in TIEKE's (Finnish Information Society Development Center) e-invoice directory. If the invoice cannot be delivered electronically, it will be sent to the same address as the decision.

Please note that employer's liability component is directly enforceable. An unpaid liability component may cause an entry in your credit information.

If you are dissatisfied with a decision we have made concerning the liability component, you can appeal to the Social Security Appeals Board. You can appeal a decision made by the Social Security Appeals Board at the Insurance Court. Judgments made by the Insurance Court cannot be appealed.

Submit your appeal to us within 30 days of receiving notification of the decision. We will consider the employer to have received the notice on the seventh day after the date when the decision was sent. We will consider State accounting units and municipalities to have received notice on the day when the decision arrives. You will receive more detailed instructions on the appeal process and how to appeal along with the decision.

If we accept the demands set out in the appeal in all regards, we will issue a revised decision. If we are unable to adjust the decision that you are appealing in accordance with your demands, we will submit the appeal to the Social Security Appeals Board.

Note that employers must pay the liability component even if the decision concerning the liability component has been appealed. In such cases, you can petition the Social Security Appeals Board to suspend enforcement, either when you appeal or by submitting a separate application.

You can file for a refund of the liability component in two situations:

We will only issue a refund of the liability component in cases in which the liability component has been paid due to a dismissed employee’s entitlement to continued unemployment allowance. In both cases, we will refund the proportion of the liability component for continued unemployment allowance that has not been used. The employer must apply for a refund of the liability component within five years of the earliest date upon which the application could have been submitted. Apply for a refund on the application form (only in Finnish and in Swedish). Attach a clarification to the application indicating the type of employment, or a statement of the supplementary pension granted to the employee.

Form for a refund of the liability component (re-employed person) (in Finnish)

Form for a refund of the liability component (laid off person taken back to work) (in Finnish)

Form for a refund of the liability component (supplementary pension) (in Finnish)

We may decide not to collect the liability component in full if the employer’s financial position has substantially deteriorated since the dismissal that constituted the basis for the liability component and if collecting the liability component in full would jeopardise the continuity of the employer's operations. In such cases, the employer must provide a reliable account of its financial position.

Liability component cases expire when five years has elapsed since the dismissed employee transferred to continued unemployment allowance or when the dismissed employee reaches the age of 63, 64 or 65. After this, we can no longer issue decisions on liability component cases.